Your Insurance Claim Lifeline: Finding the Right Support

Why Getting Help with an Insurance Claim Matters

Help with an insurance claim can make the difference between a fair settlement and a financial burden. Here's what you need to know:

Quick Guide to Getting Insurance Claim Support:

- Document everything - Take photos/videos of all damage immediately

- Contact your insurer - Report the loss as soon as possible (within 90 days to 1 year depending on your policy)

- Review your policy - Understand your coverage limits, deductibles, and exclusions

- Get professional inspection - A contractor or public adjuster can assess damage accurately

- Work with the adjuster - Be present during inspections and provide thorough documentation

- Negotiate if needed - Don't accept the first offer if it seems low; gather independent estimates

When a storm damages your Colorado home, you face a complex process of insurance jargon, deadlines, and negotiations. For most homeowners, filing a major claim is a new and high-stakes experience. The good news? You don't have to do it alone.

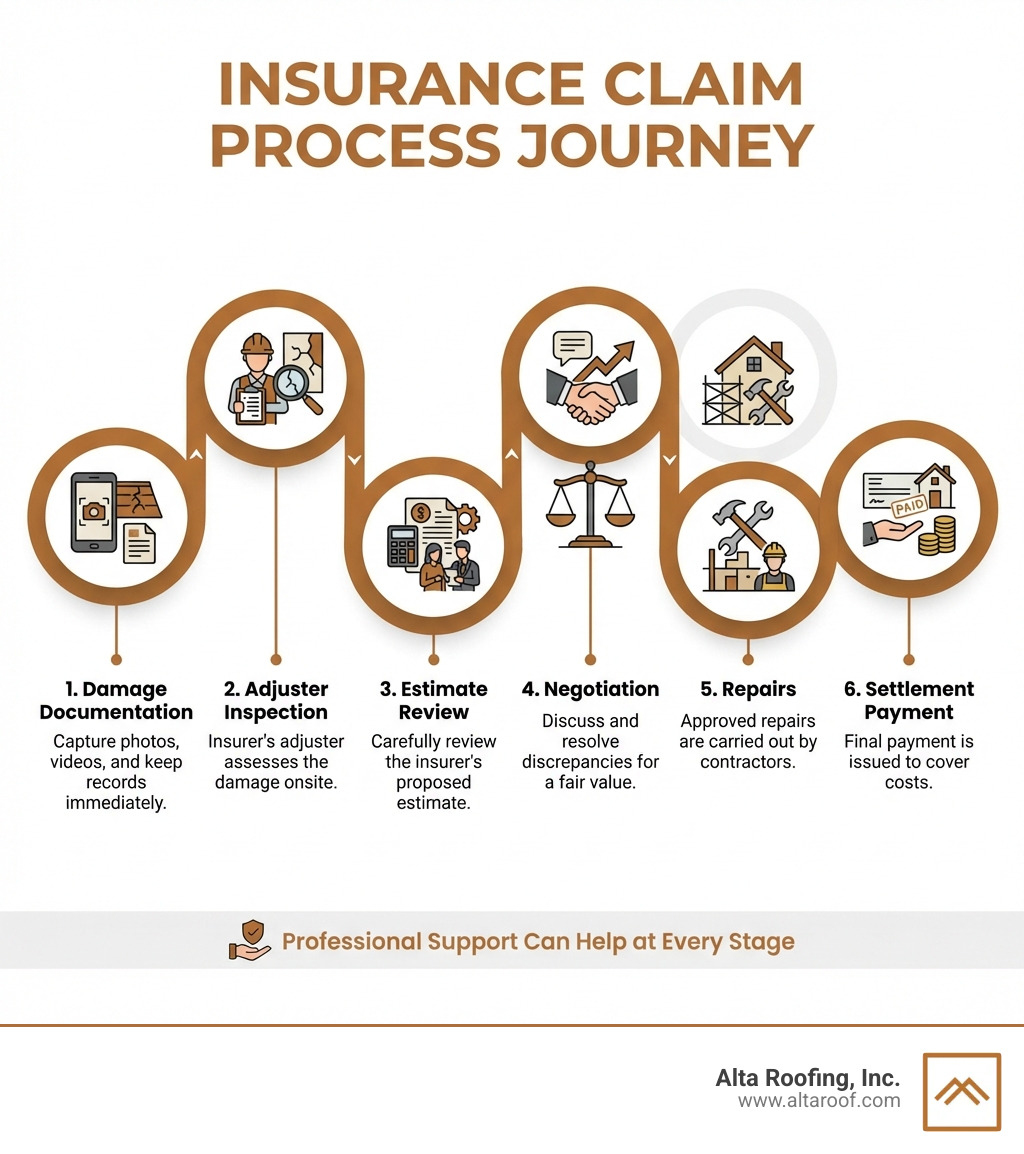

The claim process has multiple stages, and understanding them helps avoid costly mistakes. Many homeowners are unaware of policy time limits for filing claims and resolving disputes, which can lead to denials or reduced settlements.

Professional support matters. Research shows that insurance companies are more likely to take seriously the assessments provided by experienced contractors who understand property damage and the language adjusters use. A knowledgeable contractor acts as your advocate, pointing out overlooked damage and ensuring you receive fair compensation.

Insurance policies are legal contracts. The difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV) alone can mean thousands of dollars. RCV pays the full replacement cost, while ACV subtracts depreciation, significantly lowering your payout.

I'm Barry Goers, and through my work in the construction industry and as founder of Tarben Ventures Ltd., I've seen how overwhelming the insurance claim process can be. Having guided countless property owners through complex claims, I know that the right help with an insurance claim can transform a stressful ordeal into a manageable process with a fair outcome.

Step 1: Immediate Actions and Documentation After a Loss

When disaster strikes your Colorado home, the first few hours are critical. Immediate action can significantly impact your insurance claim's success. Our goal is to help you protect your property and gather evidence.

Prioritize safety and evacuate if necessary. Once safe, protect your property from further damage by making reasonable temporary repairs, like tarping a damaged roof in Aurora or turning off the water for a burst pipe in Lakewood. These actions are often required by your policy to prevent jeopardizing your claim. Keep all receipts for these repairs, as they are typically reimbursable.

Next, document everything with your smartphone. Take extensive photos and videos of all damage, inside and out, using both wide shots and close-ups. A pre-existing home inventory is invaluable for substantiating your loss.

If the damage is due to theft or vandalism, file a police report immediately and obtain a copy.

Finally, contact your insurer as soon as possible. Most companies have time limits, from 90 days to 12 months, to submit a claim. When you call, have your policy number ready and provide a clear description of the damage.

What Documentation Do I Need?

Thorough documentation is vital for a smooth process and fair settlement. Gather these essential documents:

- Your Insurance Policy Number: The first thing your insurer will ask for.

- Photos and Videos of the Damage: Visual evidence is incredibly powerful. Date and time-stamp them if possible.

- Receipts for Temporary Repairs: Any money you spend to mitigate further damage should be documented.

- Detailed List of Damaged or Lost Items: Include brand names, model numbers, age, and original purchase price if known.

- Contractor Estimates: A professional's detailed estimate, like from a roofer inspecting hail damage in Castle Rock, is crucial.

- Correspondence Log: Record every interaction with your insurance company, including dates, names, and what was discussed.

- Police Reports: For claims involving theft or vandalism.

- Medical Records/Bills: For personal injury claims, though our focus is on property.

Understanding Your Initial Responsibilities

Your policy outlines responsibilities you must fulfill after a loss to prevent delays or denials.

First, you are responsible for preventing further damage. This means taking reasonable steps like placing tarps over a damaged roof in Manitou Springs to prevent water intrusion. This is often a policy requirement.

Second, do not discard damaged property until the adjuster has inspected it. If you must remove items for safety, document them with photos before disposal.

Third, keep meticulous records of all expenses, including temporary repairs and additional living expenses if your home in Elizabeth becomes uninhabitable.

Finally, report the loss promptly. Most policies require timely notification. Delaying could be seen as a failure to meet your obligations.

For more information about how we can help with restoration services, visit our website: More info about our restoration services.

Step 2: Understanding Your Policy and the Key Players

Navigating an insurance claim requires understanding your policy. It's a legal contract outlining your rights, your responsibilities, and what the insurer is obligated to cover.

We encourage clients in Parker and Golden to review their policy documents. Note your coverage limits (the maximum payout) and your deductible (the amount you pay before coverage begins). For a $15,000 repair with a $1,000 deductible, you pay $1,000 and insurance covers $14,000.

Equally important are the exclusions, which specify what is not covered. Common exclusions include damage from floods, earthquakes, or wear and tear. Understanding these details upfront prevents surprises.

The insurance adjuster is a key figure who inspects the damage to determine the payout. They assess the 'scope of loss'—the extent of damage and materials needed for an estimate—to decide what the insurer will cover.

Replacement Cost Value (RCV) vs. Actual Cash Value (ACV)

One of the most significant distinctions in property insurance is whether your policy covers Replacement Cost Value (RCV) or Actual Cash Value (ACV). This difference can mean thousands of dollars, and it's something we make sure our clients in Arvada and Woodland Park understand.

Actual Cash Value (ACV) policies pay the depreciated value of your damaged property. Depreciation is the reduction in value due to age and wear. For example, if your 10-year-old roof in Highlands Ranch needs replacement, an ACV policy might only pay 50% of the cost, minus your deductible.

Replacement Cost Value (RCV) policies pay the amount needed to replace your damaged property with new items of similar quality, without deducting for depreciation. With an RCV policy, that same roof replacement would be fully covered (minus your deductible). RCV claims are often paid in two stages: an initial payment for the ACV, and a second payment for the recoverable depreciation once repairs are completed.

Here's a quick comparison:

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Payout Basis | Current market value minus depreciation | Cost to replace with new, similar item |

| Depreciation | Deducted from payout | Not deducted from final payout (may be initially withheld) |

| Initial Check | Often lower, reflecting depreciated value | May be lower (ACV portion), with second check for depreciation |

| Final Payout | Covers depreciated value only | Covers full cost of replacement (after repairs are completed) |

| Cost | Generally lower premiums | Generally higher premiums |

Understanding your policy type is crucial for setting expectations. We can help you review your policy to clarify this detail.

How to Interact with the Insurance Adjuster

The insurance adjuster, employed by your insurer, assesses the damage to determine the settlement. They represent the insurer's interests.

When the adjuster comes to your property in Littleton or Lone Tree, we recommend having your contractor present. An experienced roofing contractor can speak the adjuster's technical language and point out damage that might be overlooked.

During the inspection, be present with your documentation: photos, videos, a list of damaged items, and repair receipts. Be polite but firm in presenting your evidence. Don't be afraid to ask questions about their assessment.

It's also wise to verify the adjuster's identity by asking for their name and company ID. Document all interactions, including the date, time, and details of your conversations. This log can be invaluable if discrepancies arise.

How to Get Professional Help with an Insurance Claim

Dealing with property damage is stressful. Getting professional help with an insurance claim can be a game-changer. For complex storm damage, specialized contractors, public adjusters, or legal counsel provide invaluable support.

For homeowners in Fountain, Centennial, and throughout Colorado, we specialize in being that single point of contact. We help steer the complexities, ensure proper documentation, and work to maximize your settlement so you can get your home back to normal.

The Role of a Specialized Contractor

When it comes to property damage like a storm-damaged roof, a specialized contractor like us plays a pivotal role beyond just making repairs. We act as your advocate throughout the insurance claim process.

- Advocacy: We represent your best interests, ensuring your voice is heard and your claim is handled fairly.

- Damage Assessment Expert: Our team has extensive experience identifying storm damage that might be missed by an untrained eye, from subtle hail impacts to wind-lifted shingles.

- Technical Language: We speak the same technical language as insurance adjusters, allowing for clearer communication and accurate documentation.

- Negotiating with Adjusters: We can be present during the adjuster's inspection to point out all damages. If there's a discrepancy, we provide supporting documentation to help negotiate a fair settlement.

- Ensuring Quality Repairs: Our goal is to restore your home to its pre-damage condition, ensuring repairs meet industry standards and local building codes.

You can see examples of our commitment to quality work and satisfied customers by visiting: See examples of our work.

When to Seek help with an insurance claim

Wondering if you need professional help with an insurance claim? An expert makes a significant difference in these situations:

- Complex Damage: If your home has sustained extensive or unusual damage, a professional ensures every detail is accounted for.

- Large-Loss Claims: For claims involving substantial costs, the stakes are higher. Expert assistance can help secure a more favorable outcome.

- Disagreements with the Adjuster: If you and the adjuster disagree on the damage or repair costs, a contractor can provide an independent assessment to support your position.

- Feeling Overwhelmed: If you're drowning in paperwork and technical jargon, professional help can lift that burden.

- Lack of Time or Expertise: Many homeowners lack the time or knowledge to manage a complex claim. Outsourcing this to an expert lets you focus on your family.

We are experts in handling insurance claims. If you're facing property damage in Castle Pines or Monument, don't hesitate to reach out. We offer consultations to discuss your situation. Contact Us for a consultation.

Step 3: Navigating a Denied Claim or Unsatisfactory Settlement

Even with thorough documentation, you might face a denied claim or an unsatisfactory offer. This is frustrating, but it's not the end. We can help you understand your options and fight for a fair outcome.

Common reasons for claim denial include:

- The damage is not covered by your policy (e.g., flood damage).

- The damage was caused by an excluded peril (e.g., wear and tear).

- Failure to report the claim within the specified time limits.

- Insufficient documentation of the damage.

A low settlement is often just an initial offer that doesn't account for all damages or current costs. This is where negotiation begins.

What to Do if Your Claim is Denied

If your claim is denied, remain calm and follow a structured approach.

- Review the Denial Letter Carefully: The letter should state the reason(s) for the denial and cite specific policy language. Understanding why is the first step to an appeal.

- Gather Additional Evidence: If the denial is based on insufficient documentation, gather more detailed photos, contractor reports, or expert opinions.

- Write an Appeal Letter: Compose a formal letter to your insurer. State your policy and claim numbers, and explain why you believe the denial is incorrect, providing all supporting evidence.

- Escalate to a Claims Manager: If your initial appeal is unsuccessful, ask to speak with a supervisor or claims manager.

- Seek External Assistance: If internal appeals fail, contact your state's Department of Insurance. For Colorado residents, the Colorado Division of Insurance (DORA) offers a consumer assistance program. File a Complaint | DORA - Colorado Division of Insurance.

For more in-depth information, you can refer to the Residential Property Claims Guide. While specific to California, its principles are universally helpful.

How to get help with an insurance claim settlement

If the settlement offer seems too low, it's time to negotiate. Don't accept the first offer if it doesn't cover the full cost of repairs.

- Get Independent Estimates: Obtain at least two detailed repair estimates from reputable contractors like Alta Roofing, Inc. These provide strong, objective evidence for your negotiation.

- Document Discrepancies: Compare your contractor's estimates with the insurer's offer, highlighting any areas that were undervalued or missed.

- Present Your Case Clearly: Submit your independent estimates and documentation to your insurer and schedule a call to discuss the discrepancies.

- Know Your Rights: Familiarize yourself with fair claims settlement practices in Colorado. Insurers have an obligation to act in good faith.

- Consider Mediation: Colorado offers mediation programs through its Department of Insurance for claim disputes. A neutral third party helps you and the insurer reach a settlement.

- Contact the State Department of Insurance: If negotiations stall, filing a complaint with the Colorado Division of Insurance (DORA) can prompt a review of your claim.

The payment process often involves multiple checks. For major repairs, your insurer might issue an initial check for the Actual Cash Value (ACV). The remaining amount (recoverable depreciation) is paid after repairs are completed and you submit invoices. If you have a mortgage, checks may be made out to both you and your lender.

Frequently Asked Questions about Insurance Claims

We hear a lot of questions from homeowners in Englewood and across the Front Range about insurance claims. Here are some of the most common ones:

How long do I have to file an insurance claim?

The time limit to file a claim varies by policy and loss type, but generally ranges from 90 days to 12 months from the date of loss. Some policies have different stipulations.

It is crucial to contact your insurer as soon as possible. This helps you understand your deadline and ensures you don't miss out on coverage. Early reporting also allows for a quicker damage assessment.

Will filing a claim increase my insurance premium?

This is a common concern, and the answer is: possibly. It depends on several factors:

- Type of Claim: "Act of God" claims, such as those from hail or wind (common in Colorado), are generally less likely to impact premiums than "at-fault" claims.

- Your Claims History: A history of multiple claims in a short period can lead to higher premiums or even non-renewal.

- Your Insurer's Policies: Each company has its own underwriting guidelines.

- Overall Market Conditions: Rates are also influenced by the frequency of claims in your region and rebuilding costs.

While a single weather-related claim might not drastically increase your rates, it's wise to discuss the potential impact with your agent, especially if the damage is minor.

What are common exclusions in a homeowners policy?

Understanding what your policy doesn't cover is as important as knowing what it does. Here are common exclusions:

- Floods: Standard policies exclude flood damage. This requires a separate policy, typically through the National Flood Insurance Program (NFIP).

- Earthquakes: Like floods, earthquake damage is excluded and requires separate coverage.

- Wear and Tear: Damage that occurs gradually from normal use or aging is not covered.

- Lack of Maintenance: If damage results from failure to maintain your home (e.g., not cleaning gutters), your claim may be denied.

- Pest Infestations: Damage from termites, rodents, or other pests is almost always excluded.

- Sewer Back-up/Sump Pump Failure: These issues often require an additional endorsement to your policy.

It's vital to read your policy to understand exactly what is and isn't covered. Ask your insurance agent for clarification if you're unsure.

Conclusion

Navigating a Colorado insurance claim after property damage is a daunting journey, from initial shock to final repair. However, you don't have to walk this path alone.

The key takeaways are clear: act promptly, document carefully, and understand your policy. Knowing the difference between RCV and ACV, your deductible, and exclusions will empower you in discussions with your insurer.

Crucially, the value of professional help with an insurance claim cannot be overstated. A specialized contractor like Alta Roofing, Inc., acts as your advocate. We bring expert damage assessment, technical communication, and negotiation skills to ensure your claim is handled fairly. Our goal is to simplify the process, ensuring all damage is identified and covered, leading to a quality repair that restores your home. We pride ourselves on being that single point of contact, guiding you every step of the way.

By taking control of your claim and leveraging expert support, you can transform a stressful experience into a manageable one, securing the fair settlement you deserve.

Ready to explore how we can provide the help with an insurance claim you need? Explore our storm damage services.